A company that qualifies for group relief may surrender a maximum of 70 of its adjusted loss for a year of assessment to one or more related companies. What is the Corporate Tax Rate in Malaysia.

Business Income Tax Malaysia Deadlines For 2021

24 above MYR 600000.

. The Self Assessment System SAS of taxation in Malaysia has created challenges for companies in the area of tax compliance. Automatic Exchange of Information AEOI Double Taxation Agreement. For the purpose of the Malaysia corporate tax rate a small or medium company is one that is incorporated in the country.

Malaysia Corporate - Tax administration Last reviewed - 13 June 2022. Bayaran Cukai Keuntungan Harta Tanah Available in Malay Language Only International. There is also an investment tax allowance ranging from 60 to 100 as well as reinvestment allowances of up to 60 on your.

Malaysia Corporate - Deductions Last reviewed - 13 June 2022. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website. Headquarters of Inland Revenue Board Of Malaysia.

The need to estimate the taxable position of companies in advance the. Businesses can take advantage of a variety of tax incentives and tax exemption schemes. WHT Dividends 1 Interest 2 Royalties 3a 3b Special classes of incomeRentals 4 5 Resident corporations.

Corporate - Taxes on corporate income. Assessment of income is on a current-year basis. Within 7 months after the end of a companys assessment year Form C will be filed tax repayable is made in 30 days and advance tax paid in access will be returned.

Small and medium-sized businesses SMEs pay a significantly different. Under SAS the burden of responsibility has shifted from Malaysian Inland Revenue Board MIRB to the taxpayer. 3 of audited income.

Speaking at a briefing on Peroduas budget wish list Aminar Rashid said 2013 is going to be a. April 15 2022. Corporate tax rate for resident small and medium-sized enterprises with capitalization under MYR 25 million 17 on the first MYR 600000.

This is a smaller average than what we had the previous year. Small and medium companies are subject to a 17 tax rate with the balance in this case being subject to the 24 rate. The CP38 notification is issued to the employer as supplementary instructions to clear the balance of tax liability of employees over and above the Monthly Tax Deductions MTD 30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income.

The period in which a company may surrender its adjusted loss is limited to the first three consecutive years of. Corporate Tax Rate in Malaysia remained unchanged at 24 percent in 2021 from 24 percent in 2020. The current CIT rates are provided in the following table.

Malaysia Corporate - Group taxation Last reviewed - 13 June 2022. For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia. Ibu Pejabat Lembaga Hasil Dalam.

Tax rates of corporate tax as of Year of Assessment 2021. Malaysian resident corporations trading in Malaysia are subject to the corporation tax Malaysia 2020. For example if you want to reduce company tax payable in Malaysia pioneer status firms can receive up to ten years of tax holidays.

For example a. Income tax rates. On the First 5000.

The standard corporate tax rate is 24 for Malaysian companies as well as for branches that operate here. Corporate tax is governed under the Income Tax Act 1967 which applies to all companies registered in Malaysia for chargeable income derived from Malaysia including business profits dividends interests rents royalties premiums and other income. Malaysia Corporate Tax Deductions.

Headquarters of Inland Revenue Board Of Malaysia. This page provides - Malaysia Corporate Tax Rate - actual values historical data forecast chart statistics. Hantar anggaran cukai secara e-Filing e-CP204 atau borang kertas CP204 ke Pusat Pemprosesan Maklumat LHDNM secara manual.

Chargeable income MYR CIT rate for year of assessment 20212022. Read an April 2022 report prepared by the KPMG member firm in Malaysia. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million are taxed at the following scale rates.

Corporate tax for companies originating in the Territory of Labuan and operating a trading activity in this territory. Initial allowance is granted in the year the expenditure is incurred and the asset is in use for the purpose of the. Much like personal income tax corporate income tax is applied on a companys chargeable income after applying tax deductions.

A company is taxed on income from all sources whether business or non-business arising in its financial year ending in the calendar year that coincides with that particular year of assessment. See Note 5 for other sources of income subject to WHT. Last reviewed - 13 June 2022.

On the First 5000 Next 15000. Capital allowance tax depreciation on industrial buildings plant and machinery is available at prescribed rates for all types of businesses. Corporations making payments of the following types of income are required to withhold tax at the rates shown in the table below.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. These businesses are subject to a 24 percent tax rate Annually. Corporate Tax Rate in Malaysia averaged 2612 percent from 1997 until 2021 reaching an all time high of 30 percent in 1997 and a record low of 24 percent in 2015.

Though it is uncertain whether Fridays announcements will include a reduction of the corporate tax rate the managing director of Perodua Malaysias leading compact car manufacturer has urged the government to implement such a cut. Shares In Real Property Company RPC Procedures For Submission Of Real Porperty Gains Tax Form. The Malaysian Inland Revenue Board has issued the tax corporate governance framework TCGF and guidelines to assist organizations in designing and operating their TCGF and encourage voluntary participation in the TCGF programme.

Dari luar Malaysia bagi syarikat insurans pengangkutan laut dan udara dan perbankan sahaja.

Company Tax Computation Format 1

List Of Tax Deduction For Businesses Cheng Co Group

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

What Are The 3 Definitions Of Smes In Malaysia

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

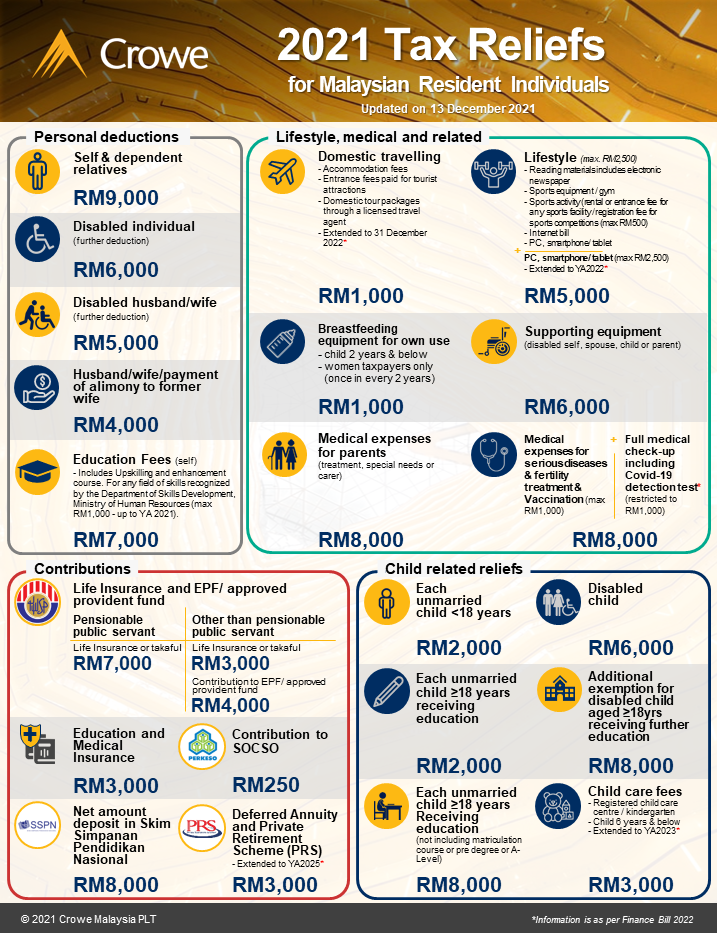

Infographic Of 2020 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia Plt

Business Income Tax Malaysia Deadlines For 2021

The Complete Income Tax Guide 2022

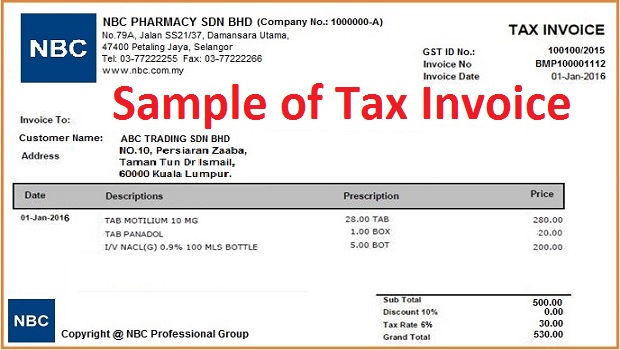

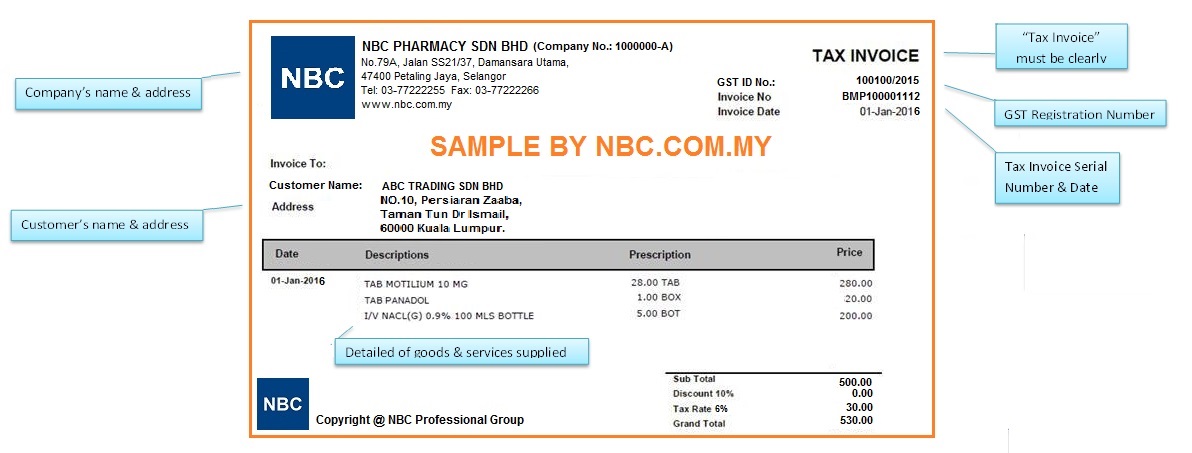

What Is Tax Invoice How To Issue Tax Invoice Goods Services Tax Gst Malaysia Nbc Group

Corporate Income Tax In Malaysia Acclime Malaysia

Infographic Of 2021 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia Plt

Cukai Pendapatan How To File Income Tax In Malaysia

What Is Tax Invoice How To Issue Tax Invoice Goods Services Tax Gst Malaysia Nbc Group

Updated Guide On Donations And Gifts Tax Deductions

Taxplanning So You Want To Start Your Own Business The Edge Markets

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Corporate Income Tax In Malaysia Acclime Malaysia

Special Tax Deduction On Rental Reduction

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets